5 Ways Analytics Are Disrupting Supply Chain Management

Harmonizing supply chain management analytics will put organizations on a path to automating their operations.

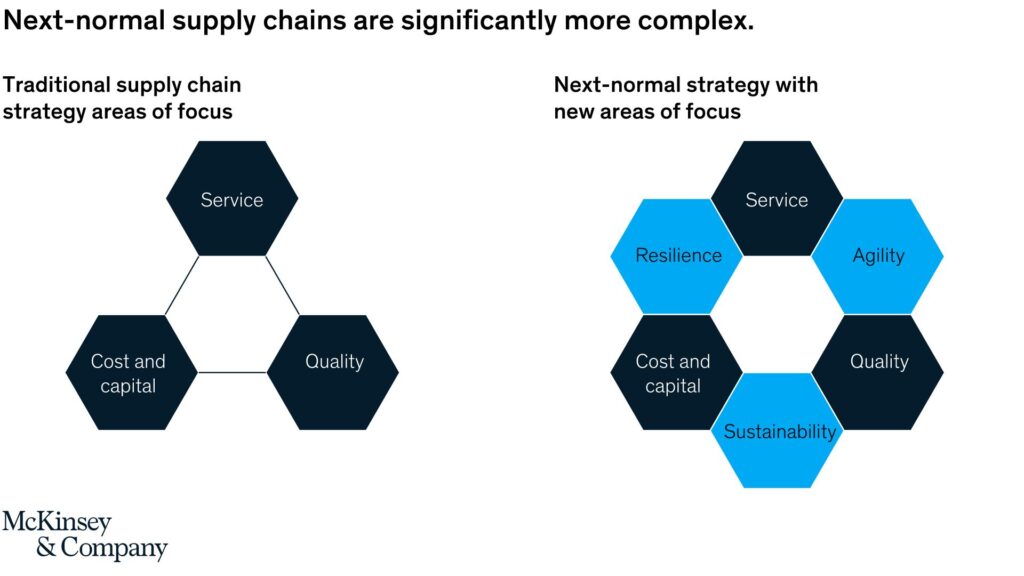

The evolution of infotech increased customer expectations, economic behavior, and other competitive priorities have caused firms to modify themselves in the current business landscape. Supply chains globally are becoming more complex, thanks to globalization and the consistently changing dynamics of demand and supply. As per a forecast by Gartner, the global supply chain management market was valued at USD 15.85 billion in 2020 and is expected to reach almost USD 31 billion by 2026.

Businesses are channeling the power of big data analytics to disrupt transformations at all levels of supply chain management. Data started as a fundamental component of digital transformation and is now a revolutionary concept. It is the key to achieving breakthroughs in supply chain management systems, and more organizations are integrating data analytics to mine data for proactive insights and accelerate intelligent decision-making.

Big data implementation in supply chain management addresses several issues, from strategic to operational to tactical. It includes everything from building efficient communication between suppliers and manufacturers to boosting delivery times. Decision-makers can utilize analytics reports to increase operational efficiency and boost productivity by closely monitoring the system’s performance at each level.

What is Big Supply Chain Analytics, and How Does it Work?

Integrating big data analytics with the supply chain makes big supply chain analytics enable business executives to compute better growth decisions for all possible maneuvers by combining data and quantitative methodologies. Notably, it adds two features.

First, it broadens the dataset for analysis beyond internal data stored in existing SCM and ERP systems. Second, it uses advanced statistical techniques to analyze the new and existing data. This generates new insights that help make better decisions for improving front-line operations and strategic decisions like implementing the best supply chain models.

Here are five ways big data and analytics are disrupting supply chain management:

1) Improved demand forecasting

Demand forecasting is one of the crucial steps in building a successful supply chain strategy. With data science and analytics in play, businesses experience automated demand forecasting. This assists them in quickly responding to fluctuations in the market and streamlining the optimal stock levels every time.

2) Enhanced production efficiency

Data science and analytics play a significant role in gauging organizational performance. Accurate application of big data analytics can help organizations track, analyze, and share employee performance metrics in real time. You can identify excellent employees who are struggling to maintain a consistent performance. This could be quickly done with IoT-enabled work badges, which exchange information with sensors installed in production line units.

3) Better sourcing and supplier management

Supply chain management systems have empowered organizations to collate data on multiple suppliers. Using data science solutions, you can leverage this data to gain insights into the historical record of any supplier. With this, you can gauge based on crucial metrics such as compliance, location, reviews, feedback, services, etc.

4) Better warehouse management

Warehouses are acquiring modern technology and have started installing sensors to collect data on the inventory flow. This helps you build an extensive database containing information based on the weight and dimensions of the packages. With sensors installed in your warehouse, you can identify bottlenecks that obstruct the flow and can be easily resolved at the earliest with the big data-fueled systems.

5) Improved distribution and logistics

Order fulfillment and traceability are essential for business productivity and customer satisfaction. Logistics have traditionally been cost-focused and effectively look for ways that provide them competitive advantages. Data science solutions enable logistic providers to leverage data analytics to improve their operations. For instance, they use fuel consumption analytics to improve driving efficiency. With GPS technology, they can track real-time routing of deliveries and reduce long waiting times by allocating nearby warehouses.

Read more at 5 Ways Analytics Are Disrupting Supply Chain Management

Subscribe us to get updates and leave your comments below.