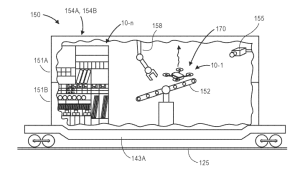

Amazon patent graphic for railroad sourcing

“Amazon wants its inventory everywhere”, writes Supply Chain Dive (Nov. 8, 2019). It is expanding its network of fulfillment locations with a focus on intermodal containers. Intermodal-based fulfillment, as Amazon’s patent application describes it, would allow the company to fulfill orders from rail, truck or ship. Here are the steps in the patent:

- 1. Load intermodal container with inventory.

- 2. A robotic system picks and loads items onto drone.

- 3. Launch and retrieval system puts the drone in appropriate position for take-off.

- 4. Drone departs container through opening in the roof.

- 5. Drone travels to a customer’s home, delivers package.

- 6. Drone meets back up with the container at a pre-calculated rendezvous point.

- 7. Variety of sensors track container’s location.

But wait, drones need new batteries, their propellers might break, and without a human in the loop how does this operation keep running smoothly? Amazon thought of this. One of the details included in the patent application is a maintenance container where drones can have a robotic technician replace propellers or batteries. Amazon says containers could be loaded with inventory before the launch of a book or video game in anticipation of demand spikes, placing inventory in locations where it expects orders.

To compete with brick-and-mortar locations, Amazon wants to cut down on delivery time making it just as convenient to hit order on the marketplace as it is to drive down the road. But this requires a complex network of inventory in fulfillment and sortation centers across the country. It has already promised one-day delivery for a variety of SKUs. Amazon claims drones will enable 30-minute delivery. Making this happen will not just require drones, but a vast web of SKUs across the country.

Read more at OM in the News: Amazon Marries Drones and Intermodal

Tag Archives: Amazon

Google and Wal-Mart team up to combat Amazon in retail supply chain shake-up

Google has teamed up with Wal-Mart in its biggest even retail partnership to challenge Amazon in the online shopping marketplace and combat the proliferation of its Alexa-powered Echo device as a means of facilitating voice shopping.

The move is expected to have a significant impact on the retail supply chain within the United States as well offering customers a whole new way of purchasing goods.

As Forbes analyst Kevin O’Marah puts it: “It signals an acceleration in the shift from store-based retail supply chains to a hyper-personalised, smart consumer supply chain.

“The dynamics of this new supply chain will be brutal for consumer brands accustomed to shelf-centric demand.”

The new partnership marks the first time that world’s largest retailer is offering products outwith its own website in the US. It announced this week that it’s going to offer a huge array of items through Google’s online shopping platform, Google Express, and eventually through its virtual assistant, Google Home.

Wal-Mart is hoping that it can integrate its large network of stores with its digital business thanks to the new partnership.

Read more at Google and Wal-Mart team up to combat Amazon in retail supply chain shake-up

Share your opinions with us in the comment box and subscribe us to get updates.

Related articles

Latest moves of Amazon and Walmart confirm the death of the middle class as we know it

Amazon, whose Prime service claims more than 70% of upper-income households in the US — those earning more than $112,000 a year — is suddenly going after customers on government assistance who earn less than $15,444 a year for a one-person household.

The retailer on Tuesday announced it would slash the cost of its monthly Prime membership nearly in half, to $5.99 a month, for customers who have an electronic benefit transfer card, which is used for government assistance like the Supplemental Nutrition Assistance Program, better known as food stamps.

“It’s a shot over the bow at Walmart,” said Doug Stephens, a retail-industry consultant. In other words, the strategy is a direct grab for Walmart’s core customers. Nearly $1 out of every $5 in SNAP benefits was spent at Walmart last year, according to Morningstar.

At the same time, Walmart is going after Amazon’s core customers with its $3 billion acquisition earlier this year of Jet.com, which attracts a younger and higher-income group of shoppers than Walmart. The retailer has also recently been snatching up trendy online retailers like ModCloth, Moosejaw, and Shoebuy, and it’s reportedly considering a bid for the high-end menswear brand Bonobos.

Read more at Amazon’s and Walmart’s latest moves confirm the death of the middle class as we know it

If you have any opinions, please express it below. Subscribe us to get updates.

Related articles

What to Expect from the Logistics & Shipping Sectors as E-Commerce Grows Up

Driven by new technologies and e-commerce growth, changes in the global supply chain are expected to impact industrial real estate for the foreseeable future.

Since 2012, Amazon has been aggressively expanding its logistics and shipping services worldwide, disrupting traditional supply chain operators with direct competition for their business.

Chinese “e-tail” giant Alibaba, meanwhile, has deployed technology that cuts into a portion of third-party logistics (3PL) operator profits.

Alibaba’s “One Touch” platform automates export-related services, such as customs clearance and logistics, to make it cost-efficient for small/medium-sized merchants to participate in the global marketplace.

Cyclical and structural factors, including overcapacity in the container shipping industry and greater use of technology in manufacturing, retail and logistics industries, are also disrupting the sector.

Automation and robots are replacing manufacturing, logistics and warehouse workers. A survey by PwC found that 59 percent of all U.S. manufacturers are using robots for some tasks.

A recent report from real estate services firm Colliers International analyzes how these changes are impacting the logistics landscape. The report also looks at the impacts on industrial and logistics properties.

Report author Bruno Berretta, associate director with Colliers International who leads the firm’s pan-European research activities, says that Amazon Prime has entered the logistics market to take control of its supply chain and improve delivery times. He notes that unofficially Amazon is becoming a 3PL service to third parties.

The company is making a big push to establish a logistics network, opening smaller distribution facilities near customers, according to Berretta, who suggests that Amazon is likely to start competing with traditional 3PL services as it opens new markets.

Additionally, Amazon wants to reduce shipping costs, which have a big impact on profits. The Colliers report notes that in 2015 Amazon spent $11.5 billion on shipping costs, which equated to 10 percent of its global sales. By delivering its own goods and using technology to streamline deliveries, the company estimates it would save $3 per package, or $1.1 billion annually.

Read more at What to Expect from the Logistics & Shipping Sectors as E-Commerce Grows Up

Feel free to express your opinions about this topic. Contact us or subscribe to get the latest updates.

Related articles

Amazon’s and Walmart’s latest moves confirm the death of the middle class as we know it

Amazon and Walmart are battling for shoppers at the highest and lowest ends of the income spectrum, leaving the middle class in the dust.

Amazon, whose Prime service claims more than 70% of upper-income households in the US — those earning more than $112,000 a year — is suddenly going after customers on government assistance who earn less than $15,444 a year for a one-person household.

The retailer on Tuesday announced it would slash the cost of its monthly Prime membership nearly in half, to $5.99 a month, for customers who have an electronic benefit transfer card, which is used for government assistance like the Supplemental Nutrition Assistance Program, better known as food stamps.

“It’s a shot over the bow at Walmart,” said Doug Stephens, a retail-industry consultant. In other words, the strategy is a direct grab for Walmart’s core customers. Nearly $1 out of every $5 in SNAP benefits was spent at Walmart last year, according to Morningstar.

At the same time, Walmart is going after Amazon’s core customers with its $3 billion acquisition earlier this year of Jet.com, which attracts a younger and higher-income group of shoppers than Walmart. The retailer has also recently been snatching up trendy online retailers like ModCloth, Moosejaw, and Shoebuy, and it’s reportedly considering a bid for the high-end menswear brand Bonobos.

Read more at Amazon’s and Walmart’s latest moves confirm the death of the middle class as we know it

If you think this article is interesting, subscribe us to get more updates. Don’t hesitate to contact us for discussion, and leave your opinions in the comment box.

Related articles

What’s Behind the Inventory Crisis of 2016?

The last time the inventory-to-sales ratio was this high was 2009, when we were in the throes of the Great Recession – people lost jobs, businesses closed, nobody was spending, nobody was growing.

What does it mean that inventory levels are this high in 2016? Are consumers not spending? Are we headed for another recession? Or are other forces at work?

Well, in April the Bureau of Economic Analysis reported that consumer spending experienced its biggest gain in six years. And while JPMorgan recently reported an increased probability of a recession in the next 12 months, no one’s sounding the alarm bells quite yet. Besides, inventory levels have been high since last fall.

So what else could be at work?

The Marketplace

Traditionally, a drop in consumer demand would cause a short-term build-up of inventory. But businesses would eventually compensate by cutting orders and manufacturers would produce less. But as we’ve seen, demand isn’t going down. And yet, inventory isn’t moving. Why?

One major culprit is the way consumers shop. Their expectations have changed. This is the age of Amazon Prime, Instacart, Uber and Lyft. Free shipping. In-store pick-up. 1-hour delivery. Easy exchanges and returns. Above all – convenience. If it isn’t convenient for a customer to buy something they want, they won’t buy it – or they’ll buy it somewhere else. Fulfillment has usurped the throne of customer satisfaction.

Traditional retailers have struggled because of this. As young, tech-driven start-ups bite into market with the luxury of fresh starts, traditional retailers have tried to stay competitive. One common tactic has been to keep buffer inventory on hand. Out-of-stock inventory kills customer loyalty. Not being able to fulfill quickly kills customer loyalty. But having lots of inventory doesn’t equate to efficient fulfillment. That requires having a modern, flexible supply chain. Without agility, retailers often lack the competence to satisfy customer demand, let alone fulfilling profitably.

Read more at What’s Behind the Inventory Crisis of 2016?

Subscribe this blog to get updates and share your opinions about this article

Related articles

Walmart and Target are refusing to surrender to Amazon

While many public companies focus their attention on embellishing their quarterly results, Amazon has always taken the long view.

The online retailer leader has invested heavily in infrastructure including a nationwide network of warehouses, robots which help ship orders, and even predictive technology that helps the company know what a customer plans to buy before he or she orders it.

Amazon even has a pioneering deal with the United States Postal Service which allows for Sunday delivery in some markets.

All of this has not come cheap, and it has hurt Amazon’s short-term profitability in some quarters, but it has helped the company build a strong competitive advantage over its chief rivals Wal-Mart and Target.

Those two physical retailers are struggling to change their supply chains to meet the needs of individual digital customers rather than stores. That’s a radical switch that requires major changes to how both brick-and-mortar chains operate.

But if either Wal-Mart or Target can hope to compete with Amazon, they have to recreate the digital leader’s ability to ship millions of products in a two-day window efficiently. Both companies seem to at least understand the problem and are taking steps to catch up.

Read more at Walmart and Target are refusing to surrender to Amazon

Subscribe us to get updates and post your opinions in the comment box below.