The threat is real, as this chart showing the rise and fall of various jobs historically shows. Agricultural workers were replaced largely by machinery decades ago. Telephonists have only recently been replaced by software programmes. This looks like good news for accountants and hairdressers. Their unique skills are either enhanced by software (accountants) or not affected by it at all (hairdressers).

The BBC website contains a handy algorithm for calculating the probability of your job being robotised. For an accountant, the probability of vocational extinction is a whopping 95%. For a hairdresser, it is 33%. On these numbers, the accountant’s sun has truly set, but the relentless upwards ascent of the hairdresser is set to continue. For economists, like me, the magic number is 15%.

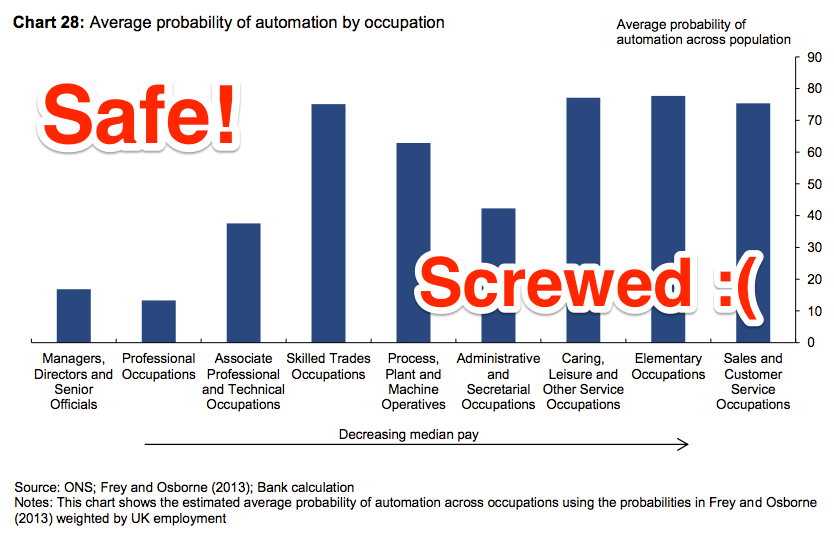

Another data analysis about jobs which will be phased out as time goes. It is an interesting analysis of historical job data. However, after I glanced through the bank report referenced in the article, I am not sure robots are the reason of the job replacement. For example, it could be replaced by cheap labor in foreign countries. The bank report shows only the jobs subject to be phased out due to technology advancement. People could just become productive. So, do not take robots too seriously!

Read more at The Bank of England has a chart that shows whether a robot will take your job

What do you think about this article? Share you opinions in the comment box and subscribe us to get updates.