“Typhoon Halong in Western Japan not only devastated regional economics and residents, it also had a significant impact on regional supply chains with an estimated loss of $10 billion in revenue. It impacted 446 production sites and took 41 weeks to fully recover.”

“The severe coastal flooding in NYC, America’s largest city, had an estimated revenue loss of $4 billion, impacted two production sites with a 38 week time of recovery.”

“Chemical spill at an Intel plant located in Phoenix, Arizona resulted in loss of production at two sites taking 10 weeks to fully recover. The technology company and its supply chain partners lost more than $900 million in revenues.”

Too often the latest headlines highlight disasters impacting geographical regions and more specifically supply chain networks. In the past year we have witnessed global disasters related to extreme weather patterns, global terrorist attacks, rising cybercrime, and slowing global economies.

Once again, managers are reminded that our supply chain organizations are increasingly operating in dynamic, uncertain environments exposing these networks to unprecedented risk. According to the British Standard Institute’s 2016 study on supply chain risk, global supply chains have incurred $56 billion in extra costs related to disruptive events. To be competitive in today’s marketplace, our supply chains must stretch across the globe in new and unfamiliar regions which are highly susceptible to disruptive events. These can negatively impact supply chain operations from an operational and profitability perspective.

Operationally, the effects of a supply chain disruption negatively impact service levels as consumers are unable to get the products they demand. A Proctor & Gamble study on inventory availability found that supply chain disruptions resulting in product unavailability results in higher customer dissatisfaction, lower brand/retailer loyalty, and, more importantly, an immediate sales loss of four percent.

In addition to customer service and sales revenue impacts, supply chain disruptions increase overall logistics costs from eight percent to 11 percent due to increases in product handling, storage, and transportation. On the inventory side, supply disruptions require companies to increase inventory investments by 14 percent to offset product non-availability in the affected area, region, or site.

From a profitability perspective, supply chain disruptions have a near and long term effect. Corporate profitability is impacted drastically at the time of a supply chain disruption with the effect extending into a three year period.

Companies who have experienced a disruption event will likely encounter the following impacts immediately: over a 100-percent drop in operating income, seven percent lower sales growth, and 11 percent growth in operational cost. In the three year period after the disruption, companies continue to experience the effects on their profitability with 30 percent to 40 percent lower stock returns resulting in average shareholder losses ranging from $129 million to $145 million per disruptive event.

Understanding the ramifications that supply chain disruptions can have, managers have moved supply chain risk management and resiliency strategies from tactical to strategic level in the company when discussing corporate goals related to consumer satisfaction/service, competitive advantage, market expansion, operational efficiencies, and profitability. The shift in supply chain priority within the company is evident as we have seen the inclusion of c-level supply chain positions, such as chief supply chain officer, included with other corporate executives (e.g. chief executive officer, chief operations officer, etc.) along with board members and shareholders to determine the company’s course of business.

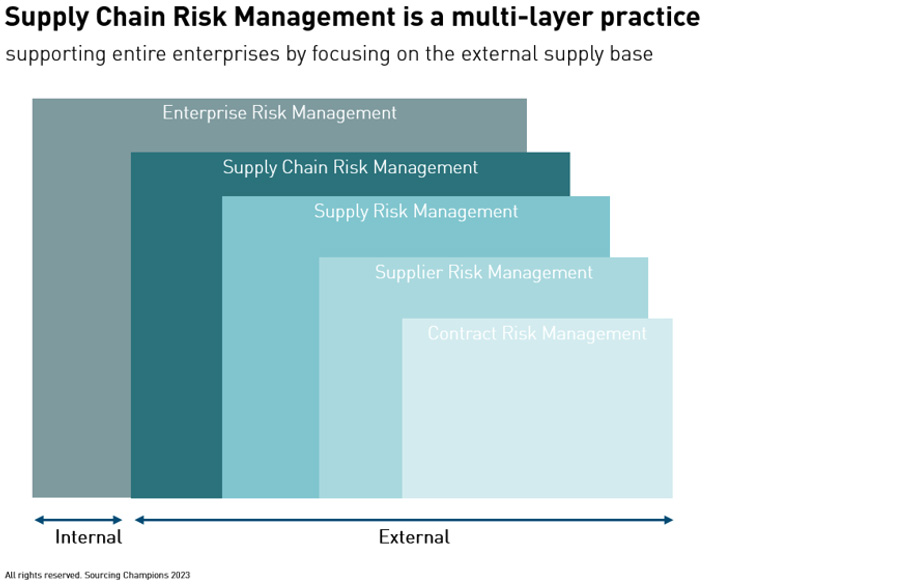

To ensure supply chains continue to keep consumers, suppliers, and the company connected to each other, these networks must be protected from unnecessary exposure to risk and failure due to faulty risk mitigation and resiliency strategies. Companies seek to incorporate use of these strategies to build higher levels of supply chain resiliency which can lessen the impacts of a disruption when it occurs as well as quickly returning the network to normal state. In order to achieve this level and type of supply chain resiliency, companies must proactively review their supply chain risk exposure using an external and internal perspective.

Externally, companies need to review their supply chain area of operations to understand their susceptibility to risks associated with economic market factors; acts of terrorism/war, changing consumer behavior and demand patterns, economic uncertainty, natural disasters, political upheaval, work stoppage, or other types of events which can lead to supply chain disruptions, delays, and inventory loss.

Internally, companies need to review their supply chain network structure to determine how well its resiliency posture can withstand a disruption and quickly return the network to a normal state. This review should include an in-depth examination of company risk associated with its network of assets, policies, people, processes, products, and systems. To conceptually understand how this external and internal review process is conducted, figure 1 below outlines the impacts and interactions these factors have on the success or failure of a company’s supply chain resiliency posture and its ability to return the organization to optimal operational performance.

Read more at Supply Chain Resiliency: Developing a Strong Posture

Please share your opinions about this article with us in the comment box. If you wish to get the latest updates in your inbox, please subscribe us.