Sustainable financial products can propel revenue growth for banks and contribute substantially to businesses’ progress in meeting global climate goals. But success requires a strategic approach.

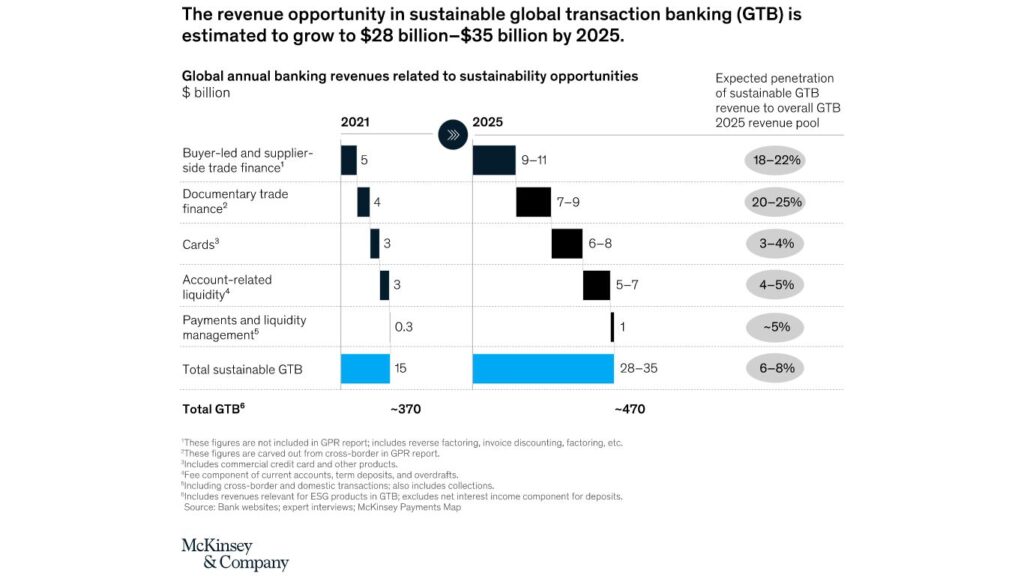

Sustainability has become a topic of crucial importance for many corporations, including financial institutions. One reflection of this is the strong growth in sustainable debt instruments, which according to BloombergNEF surpassed $1.6 trillion in 2021. In contrast, sustainable global transaction banking (GTB) is still in the early stages, but its potential for growth is significant. We estimate that revenue from sustainable trade finance and cash management products will grow by 15 to 20 percent annually to total combined revenues of $28 billion to $35 billion in 2025, with market penetration reaching approximately 25 percent in trade finance products and 5 percent in cash management products.

Research also indicates that demand for sustainable GTB products far exceeds supply (at present, only 10 percent of demand is met4 ), and we expect that in the coming years, sustainability will become a vital element of a competitive GTB offering. Surprisingly, few banks today embed sustainability in their GTB products, handing market leaders an opening to capture a disproportionate share of the market. Banks should act now to build a sustainable GTB value proposition that enables them to defend existing relationships and expand their market share while staying ahead of customer demands and the expectations of employees, investors, and the public.

Sustainability in GTB: Opportunity and imperative

Banks’ current sustainability offerings are typically incorporated in traditional lending products, and growth in these products has been remarkably strong. According to Bloomberg estimates, the combined volumes of sustainability-rated debt instruments have grown approximately 80 percent per year, increasing from approximately $155 billion in 2017 to more than $1.6 trillion in 2021.

By contrast, most banks across the world have taken only preliminary steps toward incorporating sustainability features within GTB products. This slow uptake derives in part from complexity—which arises from paper-intensive processes involving multiple parties—and from the lack of reliable data on companies’ sustainability-related activities and of industry standards for evaluating these activities.

Despite these challenges, embedding sustainability-tracking capabilities within core transaction banking services can be highly effective in improving companies’ performance on ESG metrics, as trade and payment transactions are systematic and recur frequently. What is more, trade finance rolls over frequently (every 30 to 90 days), which means that products such as supply chain finance (SCF), letters of credit, and guarantees have the potential to contribute disproportionately to new volumes in sustainable finance.

The trade finance community—including financial institutions, export credit agencies, trade organizations, technology and service providers, and corporations—is focusing on various sustainability initiatives. Diverse banks offer sustainability-linked solutions, including deposit accounts backed by investments in sustainability-rated assets and letters of credit issued for transactions in which the underlying asset (for example, batteries for electric vehicles) contributes to efforts to mitigate climate change. In addition, the number of requests for proposal (RFPs) for trade finance projects involving sustainability criteria is increasing, especially in the United States and Europe.

Read more at Sustainability in global transaction banking: A market imperative

Share your opinions below and subscribe to us to get new updates.