The trajectory of the COVID-19 crisis suggests a long-tailed recovery. The latest financial data reveals the ongoing challenges.

COVID-19 continues to dominate the headlines, and its massive influence on healthcare will extend throughout 2022. At the same time, longstanding issues demand attention. CommerceHealthcare® recently completed its annual market scan and analysis of leading issues in finance and revenue cycle management (RCM). Healthcare Finance Trends for 2022 detail eleven trends that carry significant implications for the economic and operational wellbeing of health systems, hospitals, and physician practices.

Another Year of Financial Recovery

The trajectory of the COVID-19 crisis suggests a long-tailed recovery. The latest financial data reveals the ongoing challenges.

- Margin/Profitability. More than a third of hospitals maintained negative operating margins during 2021. Estimated total industry net income loss was $54 billion and median margin 11% below pre-pandemic levels. Hospitals paid an additional $24 billion for clinical labor during the year, $17 million for the average 500-bed hospital. Medical practices have suffered as well. Under 30% of surveyed primary care practices reported being financially healthy.

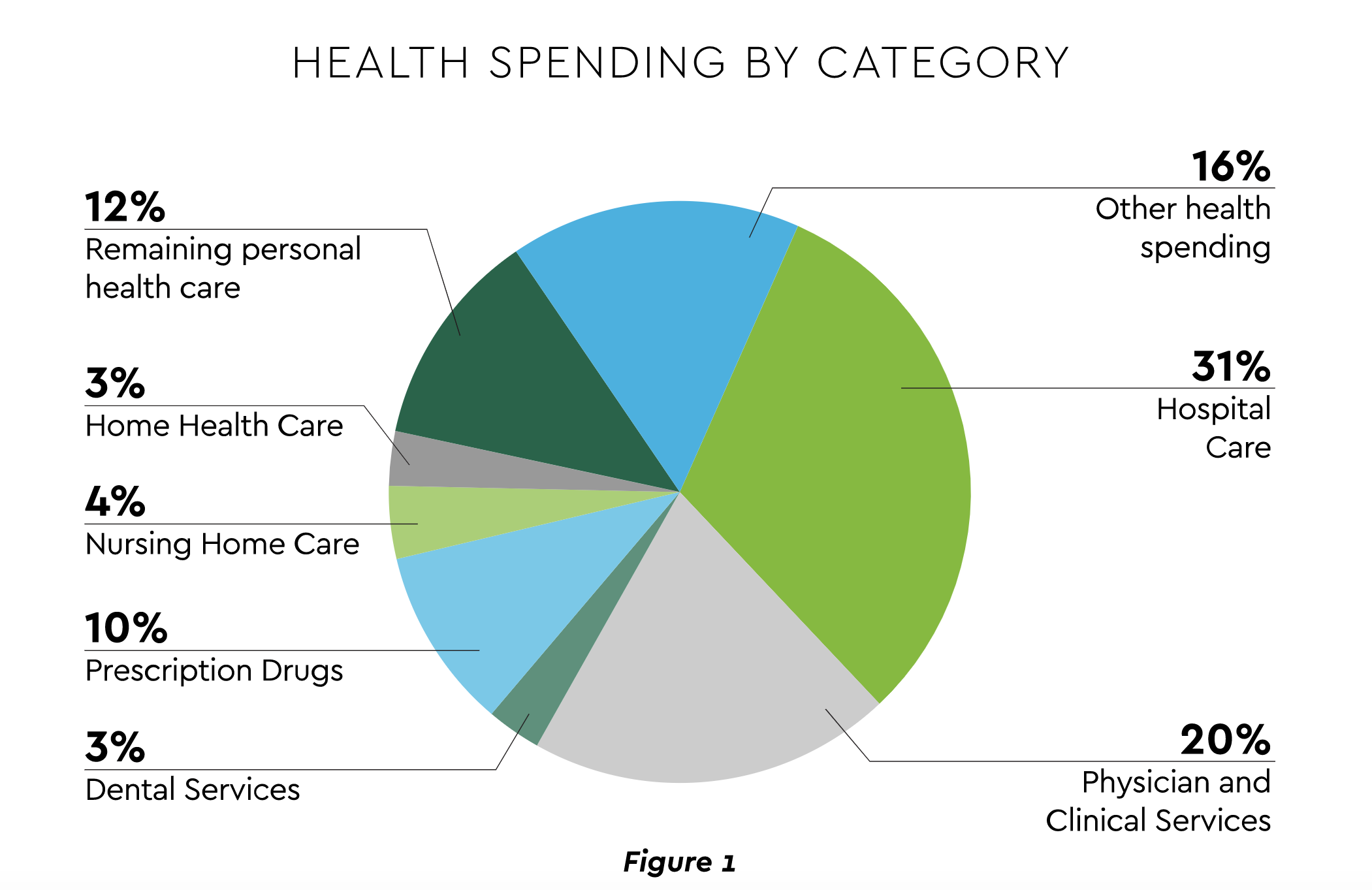

- Revenue and Volume. An encouraging but decidedly mixed picture emerges on the demand side. Through August 2021, overall healthcare spending was 7.2% higher than the previous year, distributed as displayed in Figure 1. Spending has lagged GDP growth. Hospital revenue grew, but volume of overall discharges and emergency department (ED) visits remains depressed from 2019 and flat for OR minutes. The longer-term utilization outlook sees inpatient volume decreasing 1% through the end of the decade, outpatient rising 14% and ED growing 5% for emergent and falling 15% for urgent.

- Cash/Liquidity. This metric was bolstered by COVID-19 government subsidies and expedited insurance reimbursements. Disciplined cash management will be required as these supports are removed. In fact, a recent article detailed an emerging liquidity challenge. Major insurers are behind on billions of dollars in payments for various reasons.7

- Medical Cost Trend. Another closely watched indicator is growth in employer medical costs. Forecasts for 2022 include:

- PwC: 6.5%8

- Willis Towers: 5.2%9

- Aon: 4.8%10

Health spending by category

Subscribe to us for more updates. Leave your comments below if you have opinions.

Read more at Healthcare Financial Trends for 2022