Speed in decision-making. Speed in reducing cycle-times. Speed in operations. And, speed in continuous improvement. The use of Artificial Intelligence in the supply chain is here to stay and will make huge waves in the years to come.

According to Gartner, supply chain organizations expect the level of machine automation in their supply chain processes to double in the next five years. At the same time, global spending on IIoT Platforms is predicted to grow from $1.67B in 2018 to $12.44B in 2024, attaining a 40% compound annual growth rate (CAGR) in seven years.

In today’s connected digital world, maximizing productivity by reducing uncertainties is the top priority across industries. Plus, mounting expectations of supersonic speed and operational efficiencies further underscore the need to leverage the prowess of Artificial Intelligence (AI) in supply chains and logistics.

Accelerating Supply Chain Success with AI in Supply Chains & Logistics

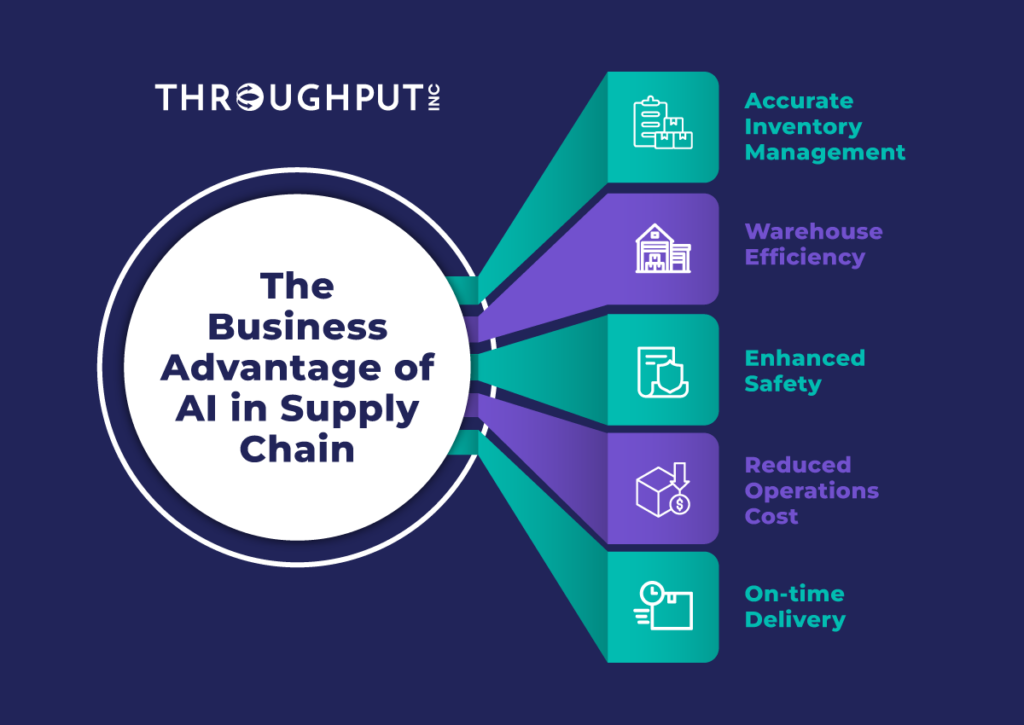

AI in supply chains can deliver the powerful optimization capabilities required for more accurate capacity planning, improved demand forecasting, enhanced productivity, lower supply chain costs, and greater output, all while fostering safer working conditions.

The pandemic and the subsequent disruptions has demonstrated the dramatic impact of uncertainties on supply chains and has established the need for smart contingency plans to help companies deal with these uncertainties in the right way.

But is AI the answer? What can AI mean for companies as they struggle to get their supply chain and logistics back on track? Let’s find out.

ACCURATE INVENTORY MANAGEMENT

Accurate inventory management can ensure the right flow of items in and out of a warehouse. Simply put, it can help prevent overstocking, inadequate stocking and unexpected stock-outs. But the inventory management process involves multiple inventory related variables (order processing, picking and packing) that can make the process both, time consuming and highly prone to errors.

WAREHOUSE EFFICIENCY

An efficient warehouse is an integral part of the supply chain. AI-based automation can assist in the timely retrieval of an item from a warehouse and ensure a smooth journey to the customer. AI systems can also solve several warehouse issues, more quickly and accurately than a human can, and also simplify complex procedures and speed up work. Also, along with saving valuable time, AI-driven automation efforts can significantly reduce the need for, and cost of, warehouse staff.

ENHANCED SAFETY

AI-based automated tools can ensure smarter planning and efficient warehouse management, which can, in turn, enhance worker and material safety. AI can analyze workplace safety data and inform manufacturers about any possible risks. It can record stocking parameters and update operations along with necessary feedback loops and proactive maintenance. This helps companies react swiftly and decisively to keep warehouses secure and compliant with safety standards.

REDUCED OPERATIONS COSTS

Here’s one benefit of AI systems for the supply chain that one simply can’t ignore. From customer service to the warehouse, automated intelligent operations can work error-free for a longer duration, reducing the number of human oversight-led errors and workplace incidents. Additionally, warehouse robots can provide greater speed and accuracy, achieving higher levels of productivity – all of which will reflect in reduced operations costs.

ON-TIME DELIVERY

As we discussed above, AI systems help reduce dependency on manual efforts, thus making the entire process faster, safer and smarter. This helps facilitate timely delivery to the customer as per the commitment. Automated systems accelerate traditional warehouse procedures, removing operational bottlenecks along the value chain with minimal effort to achieve delivery targets.

Read more at Unlocking the Value of Artificial Intelligence (AI) in Supply Chains and Logistics