Supply Chain Finance (SCF) can, and should, be a force for good in ensuring much-needed liquidity reaches all suppliers, regardless of their size and meets the objectives of buyers.

However, many suppliers, particularly SMEs, struggle to access necessary working capital, and buyers lack the motivation to set up or expand these programmes.

Wayne Mills, founder and managing director at Atom Advisory, shares his top five tips for buyers and five questions for suppliers to ensure SCF fulfils its potential to accelerate growth and underpin robust supply chains.

Five tips for buyers thinking about Supply Chain Finance

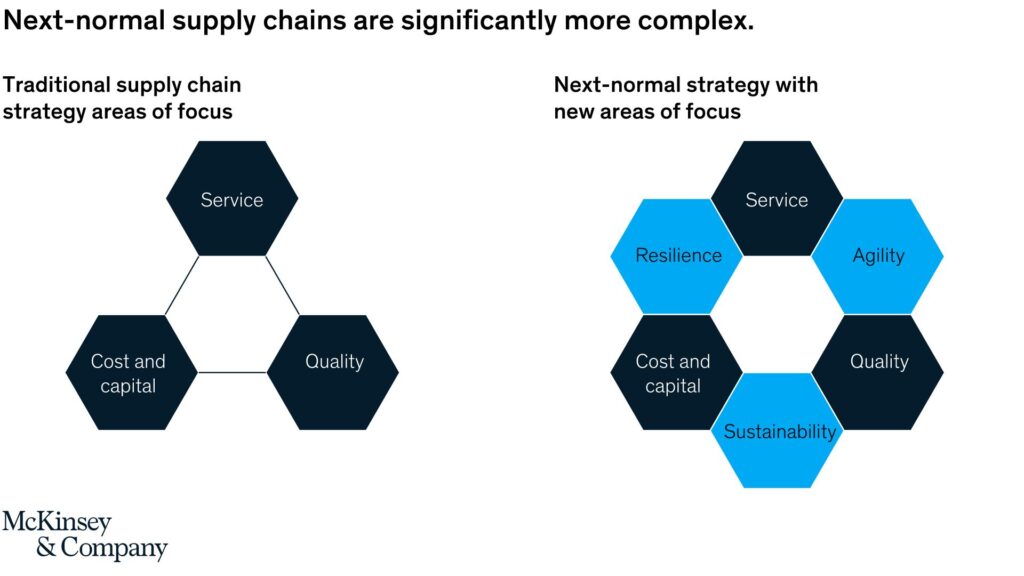

The importance of building and maintaining resilient supply chains has been well-understood for decades, but COVID-19 brought into sharp focus the need to reassess and reimagine supply chains, including supplier relationships.

The importance of building a resilient supply chain has been known for decades, but the impact of COVID-19 highlighted the need to reassess modern supply chain structures.

These five tips are a good starting place when setting up or expanding a SCF programme.

1. Define the programme objectives

2. Ensure business-wide stakeholder engagement

3. Actively support supplier understanding and onboarding

4. Review the changing external landscape

5. Align physical and financial supply chains

Five questions for suppliers to ask themselves

Whilst certainly not true in all cases, there is often an imbalance between the size and financial strength of buyers and suppliers. Careful consideration and individual assessment of SCF can deliver significant benefits to suppliers, but these five questions can help ensure positive outcomes.

1. Which buyers run a SCF programme?

2. Is SCF the right solution for me?

3. Is my working capital optimised by using SCF?

4. What is the best use of my time?

5. Which solution offers the most flexibility?

Read more at Five tips and five questions to ensure supply chain finance success

Leave your comments below or send us a message for a discussion.